Establishing a subsidiary is for sure one step further in the business field for all companies looking for expansion. International investors interested in opening a company in Qatar benefit from varied advantages and fast incorporation. A subsidiary can be established under the rules of a limited liability company. Complete support can be offered by one of our company formation agents in Qatar, on request.

| Quick Facts | |

|---|---|

| Applicable legislation (home country/foreign country) |

Qatar Company Law |

|

Best used for |

– oil&gas, – banking, – insurance, – energy |

|

Minimum share capital |

No |

| Time frame for the incorporation (approx.) |

Around 2 months |

| Management (local/foreign) |

Local |

| Legal representative required |

Yes |

| Local bank account |

Yes |

| Independence from the parent company | Not entirely |

| Liability of the parent company | Protected against litigation |

| Corporate tax rate | 10% |

| Possibility of hiring local staff | Yes |

Table of Contents

How to establish a subsidiary in Qatar in 2024

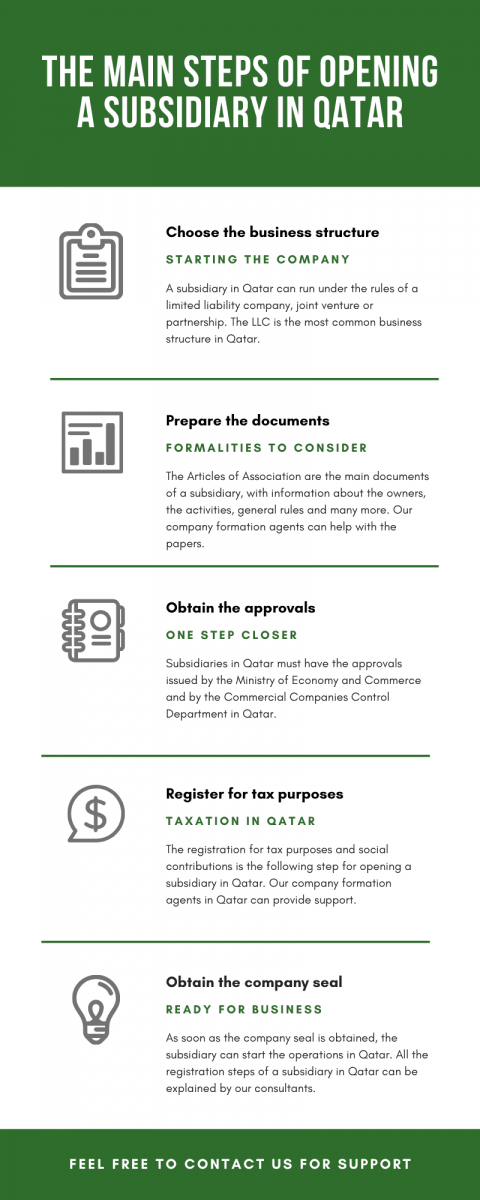

An LLC in Qatar must be formed with the help of a local investor or shareholders who will own 51% of the business. It is important to know that for full ownership of the business, this must be registered in the free trade zones of Qatar. Below you can find details about how you can establish a subsidiary in Qatar in 2024:

- The company registration starts with the Commercial Registry and Trademark Department in Qatar.

- The Articles of Association are the main documents of the future firm in Qatar.

- The name of the company must be verified and reserved in the first place.

- There is no need for minimum share capital, however, a bank account needs to be open for future financial operations.

- Registration for tax purposes is mandatory. The Tax Identification Number or TIN needs to be obtained.

- Once the licenses and permits are obtained, the business is approved and the company seal can be issued.

According to subsidiary laws for Qatar, this kind of structure cannot have more than 50 shareholders or founding members. If a minimum share capital of QAR 200,000 was needed to register a subsidiary in Qatar, this condition is no longer current.

The incorporation process of a subsidiary in Qatar is not complex, however, it is recommended to have the support and assistance of a company formation agent in Qatar who can handle all the tasks. Also, you can appoint one of our representatives to act on behalf of your future company in Qatar.

How much does it take to register a subsidiary in Qatar?

The registration of a subsidiary in Qatar in 2024 is relatively fast, but it might take time until you hire staff and take care of matters like accounting, human resources, legal aspects, etc. This is where our consultants can provide in-depth support throughout the entire registration process of a subsidiary in Qatar. We can also help you set up a company in Qatar and obtain all the necessary documents in just a few days.

Simple or general partnerships are proper structures for opening a subsidiary in Qatar and often the choice of international investors looking for a simplified entity. A shareholding company is also a suitable structure.

Qatar is one of the strongest economies in the Middle East and offers a fairly appreciated and stable business climate. Thus, international entrepreneurs can expand their portfolio with the help of subsidiaries in Qatar and can access local and foreign markets for new evolution opportunities.

Who issues the approvals for companies in Qatar?

The Ministry of Business and Trade in Qatar is in charge of issuing the necessary approvals for companies established by foreigners in this country. Even if the legislation related to foreign investments is quite permissive, there are particular rules that refer to the ownership of a business in Qatar. In some cases, foreign entrepreneurs might direct their attention to joint ventures or partnerships instead of limited liability companies for establishing a subsidiary in Qatar.

Even if it offers an optimal business climate, certain aspects can seem complex. For example, to open a subsidiary in Qatar, a Qatari national is needed to own 51% of the company. The government in Qatar has always focused on hiring Qatari nationals before any foreign investments in this country.

Sectors of interest for your subsidiary in Qatar

There are many sectors of business where large companies from abroad can set up their operations, such as telecommunication, education, manufacturing, exploitation of natural resources, agriculture, tourism, and consultancy services. These sectors are allowed to receive direct foreign investments. For further information about how to open a subsidiary in Qatar, do not hesitate to address your inquiries to our team of consultants.

We suggest you the services of our accountants in Qatar in exchange for the establishment of a whole department in the company you own. Besides the fact that the prices are advantageous, you will collaborate with a team of specialists, with experience in various areas of accounting. Also, they can propose a series of tax minimization methods for those interested in cutting the amount of taxes in the firm.

A multi-currency bank account is required for a subsidiary in Qatar and it can be opened after the incorporation of this structure. Another important step is obtaining the tax identification number issued by the Ministry of Finance and particularly the Tax Department.

What are the benefits of subsidiaries in Qatar?

Subsidiaries enjoy a specific percentage of independency, strongly supported by the limited liability company, an important business structure available in Qatar. This also protects the company from liabilities and litigations, and it is an important advantage considered by international investors wanting to open a subsidiary in Qatar. It is good to know that you can choose already registered subsidiaries in Qatar and skip the incorporation process of such an entity. The laws in Qatar address to both local and foreign entrepreneurs, but for more details in this sense, feel free to talk to our company formation agents in Qatar. You can also solicit information about taxation in Qatar.

Making investments in Qatar

Qatar is found in the western part of Asia and it is extremely appreciated from a business point of view by numerous investors. Qatar enjoys a modern and liberal market open to all kinds of investors and entrepreneurs, where approximately 88.3% of the country’s GDP is sustained by the trading sector. Even if Qatar is not part of the Customs Valuation Agreement, enabled by the World Trade Organization this is not an impediment for international investors to set up their operations in this country. Below you can find interesting facts and details about business and economy in Qatar:

- In 2017, the exports of goods registered around USD 67,000 million;

- Japan is the main trading partner of Qatar with more than 19% of imports and exports compared to 15.6% registered by South Korea;

- The trade balance is worth around USD 50,000 million for 2018 in Qatar;

- India, China, Japan, South Korea, and Singapore are the main export partners of Qatar.

Feel free to contact us for information about how to open a subsidiary in Qatar in 2024.